ME MRS 1040X-ME 2012-2026 free printable template

Show details

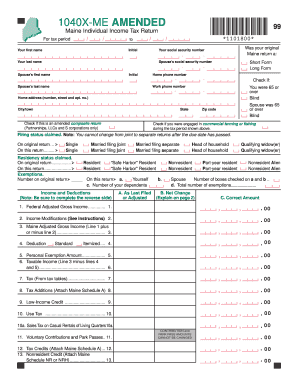

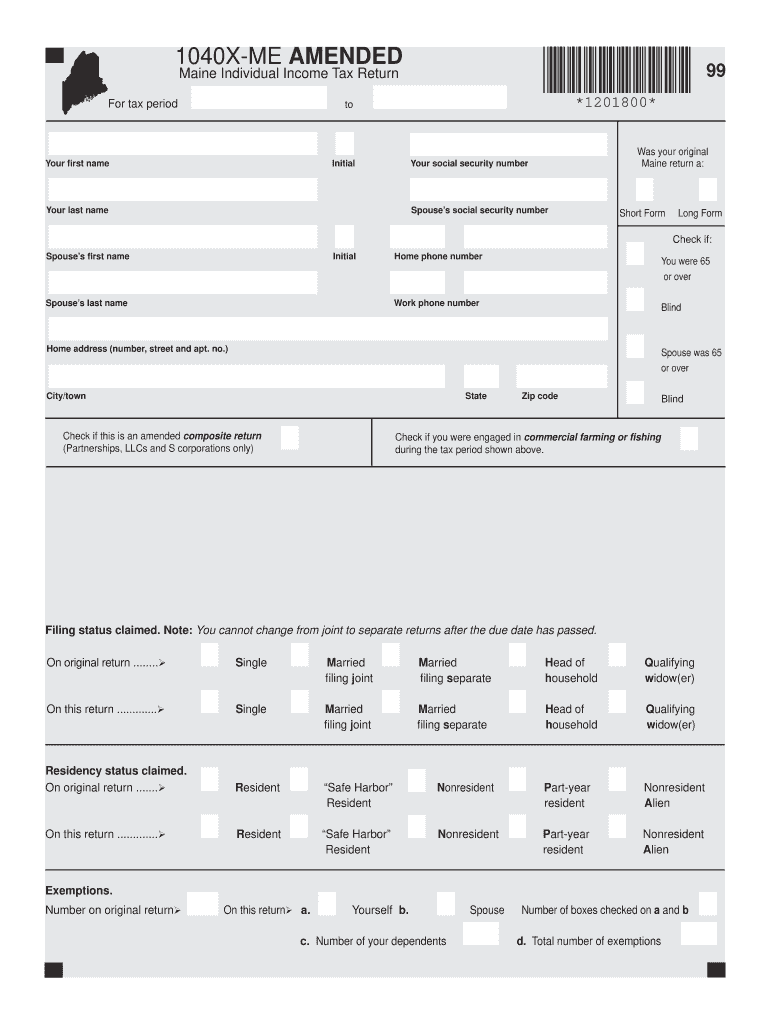

Total number of exemptions FORM 1040X-ME PAGE 2 Income and Deductions A. As Last Filed or Adjusted B. Arbor would complete line 1 of Form 1040X-ME as follows Note Be sure to complete the reverse side 15 000 0 0 0. Amended Maine income tax returns must be led within 180 days of the nal determination of the change or correction or the ling of the federal amended return. File Form 1040X-ME only after you have led your original return. Generally to receive a refund of taxes paid Form 1040X-ME...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign maine amended return form

Edit your maine amended tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maine 1040x amended form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing me individual income tax online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit maine 1040me form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME MRS 1040X-ME Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out maine form income return

How to fill out ME MRS 1040X-ME

01

Gather your original ME MRS 1040 tax return and any relevant documents.

02

Obtain the ME MRS 1040X-ME form from the Maine Revenue Services website or local offices.

03

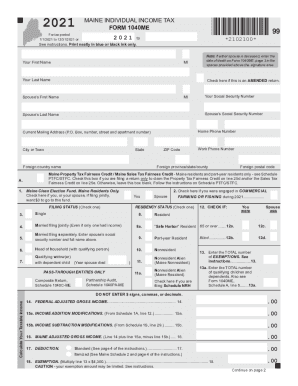

Fill out your personal information at the top of the form, including your name, address, and social security number.

04

Indicate the tax year you are amending in the designated section.

05

Complete the 'Explanation of Changes' section, providing a brief description of what you are amending and why.

06

Recalculate your tax liability based on the changes and fill in the adjusted figures for income, deductions, and credits.

07

Ensure that you clearly indicate any increase or decrease in tax due or refund.

08

Sign and date the form, providing your phone number for contact.

09

Attach any necessary schedules or documentation that support your changes.

10

Mail the completed form to the address provided on the instructions, ensuring it is postmarked by the deadline.

Who needs ME MRS 1040X-ME?

01

Individuals who need to correct errors on a previously filed ME MRS 1040 tax return.

02

Taxpayers who have received additional information that affects their tax situation after filing.

03

Those who want to claim a refund for overpaid taxes or credits not initially claimed.

04

Anyone who is addressing changes in their filing status, income, or deductions.

Fill

maine form 1040x

: Try Risk Free

People Also Ask about maine individual income tax

What is 1310 form Maine?

Form 1310ME is used to claim an income tax refund on behalf of a taxpayer who has died. The form must be completed by the person who is claiming the refund.

Who is required to file form 1310?

Use Form 1310 to claim a refund on behalf of a deceased taxpayer. If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if: You are NOT a surviving spouse filing an original or amended joint return with the decedent; and.

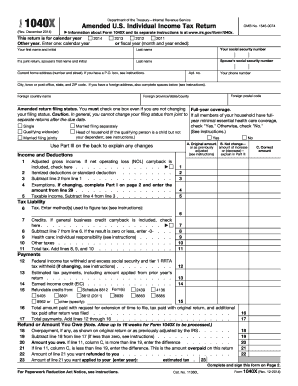

How do I apply for an amended return?

File an amended return using Form 1040-X, Amended U.S. Individual Income Tax Return as soon as possible. Include any forms and/or schedules that you're changing and/or didn't include with the original return. Return the refund check with a letter of explanation.

Does an executor have to file form 1310?

If you were named Executor or Administrator by the Register of Wills, then you are a “court appointed or certified personal representative” as defined by Form 1310. As a result, you must submit documentation that you are the personal representative of the estate.

How will I receive my amended tax refund?

You can use the Where's My Amended Return tool (which is updated every 24 hours) or call 1-866-464-2050 to check the status. Keep in mind it could take up to 16 weeks from the date of receipt for the IRS to process your return and issue your refund via paper check or direct deposit.

How long does it take to get my amended refund?

Your amended return will take up to 3 weeks after you mailed it to show up on our system. Processing it can take up to 16 weeks.

How do I get my amended refund?

The Where's My Amended Return (WMAR) online tool or the toll-free telephone number 866-464-2050 can be used for status updates three weeks after filing the return. Both tools are available in English and Spanish and have the most up-to-date information available.

How do I file an amended Maine tax return?

If you need to change or amend an accepted Maine State Income Tax Return for the current or previous Tax Year you need to complete Form 1040ME. Form 1040ME is a Form used for the Tax Return and Tax Amendment.

Can I file an amended return online?

Can I file my amended return electronically? Yes. If you need to amend your 2020, 2021 or 2022 Forms 1040 or 1040-SR you can now file Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

How do I fill out an amendment form?

0:25 2:11 Learn How to Fill the Form 1040X Amended U.S. Individual - YouTube YouTube Start of suggested clip End of suggested clip Next enter all income and deductions as they appear on your original. 1040 enter any changed amountsMoreNext enter all income and deductions as they appear on your original. 1040 enter any changed amounts and the correct amount in the appropriate boxes. Complete the form 1040x copying line for line all.

How long do you have to amend a Maine tax return?

If the Internal Revenue Service examined and changed your federal return, you must report these changes to Maine Revenue Services within 180 days, if the changes affect your Maine tax liability. You must complete an amended Form 1040ME to change your Maine return.

How long do you have to amend a Maine tax return?

If the Internal Revenue Service examined and changed your federal return, you must report these changes to Maine Revenue Services within 180 days, if the changes affect your Maine tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 1040x me instructions from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including get create make and sign pdffiller user ratings on g2. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for signing my form maine return in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your tax maine amended and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit 1040x me amended straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing how to maine amended.

What is ME MRS 1040X-ME?

ME MRS 1040X-ME is the amended individual income tax return form used in Maine to correct errors or make changes to a previously filed Maine personal income tax return.

Who is required to file ME MRS 1040X-ME?

Any individual who needs to amend their previously filed Maine personal income tax return, whether due to errors, changes in income, or eligibility for credits is required to file ME MRS 1040X-ME.

How to fill out ME MRS 1040X-ME?

To fill out ME MRS 1040X-ME, you need to complete the form by providing your personal information, the tax year being amended, details of the changes, and any additional documentation that supports the amendments. Follow the instructions carefully and ensure all required sections are filled out.

What is the purpose of ME MRS 1040X-ME?

The purpose of ME MRS 1040X-ME is to allow taxpayers to make corrections to their previously submitted Maine state income tax filings, ensuring that tax records are accurate and up-to-date.

What information must be reported on ME MRS 1040X-ME?

On ME MRS 1040X-ME, taxpayers must report their personal information, original amounts reported on the previous return, the corrected amounts, the reasons for the amendments, any changes in income or deductions, and supporting documentation, if necessary.

Fill out your ME MRS 1040X-ME online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Me Form Return is not the form you're looking for?Search for another form here.

Keywords relevant to amendment form for taxes

Related to amended tax return form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.